FINANCE

Recognizing that entrepreneurial borrowers need flexibility, certainty of closing, speed of execution and creative deal structuring, BOLOUR in 2009 launched its bridge lending platform. In the years that followed, we continued to build on that foundation, creating a comprehensive lending platform that today offers financing solutions in 17 states (CA, AZ, TX, OR, CO, ID, UT, WA, TN, NC, GA, PA, MA, MD, VA, IL, FL) and the District of Columbia. Product classes that BOLOUR lends on include: retail, office, multi-family, industrial, mixed-use, SFRs (non-owner occupied) and urban infill land.

LENDING CRITERIA

HIGH LEVERAGE BRIDGE PROGRAM

Leverage Up to 75% of Value

Rate: Starting at 8% Interest Only

Closing: 1-3 Weeks

Non-Recourse: Available

Loan Size: $4MM – $30MM

Term: Up to 24 Months

Property Types: Multifamily, Retail, Office, Industrial, Mixed-Use, Luxury SFR, Hospitality

Second Trust Deeds Available

Markets: CA, AZ, TX, FL, OR, CO, ID, UT, WA, TN, NC, GA, PA, MA, DC, MD, VA, IL

HIGHLIGHTED TRANSACTIONS

The following transactions highlight a sampling of BOLOUR closings for retail, office, multi-family, industrial, mixed-use and urban infill land.

BOLOUR NEWS

Read about our latest project successes.

Meet Gavin James: BOLOUR Acquisitions Analyst

Gavin joined our active and growing Acquisitions team in 2025, responsible for analyzing prospective transactions, supporting underwriting efforts and [...]

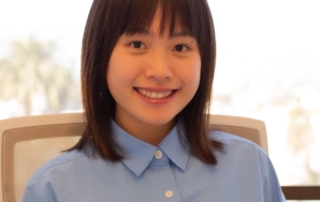

WELCOME NIKE LUO: BOLOUR PORTFOLIO ANALYST

Nike Luo has joined BOLOUR’s Lending team as Portfolio Analyst. She comes with a range of experience collected from [...]

BOLOUR hires Jason Huang as Associate Director, Debt Origination

Industry expert will support origination efforts across 17 states and District of Columbia Beverly Hills, Calif. – (February 4, [...]